In the world of tech startups, crafting a pitch to investors can be as intense and crucial as coming up with a product to begin with. The stakes are high and much-needed capital is on the line. It’s the sort of thing where practice can make all of the different – that’s what groups of college students recently got plenty of in western Massachusetts.

It wasn’t exactly an episode of “Shark Tank,” but after some six weeks of intense coding and testing, groups of Springfield College and Western New England University students made their final sales pitches to a panel of experts this month – showing off the financial tech or “FinTech” apps they developed via a special fellowship.

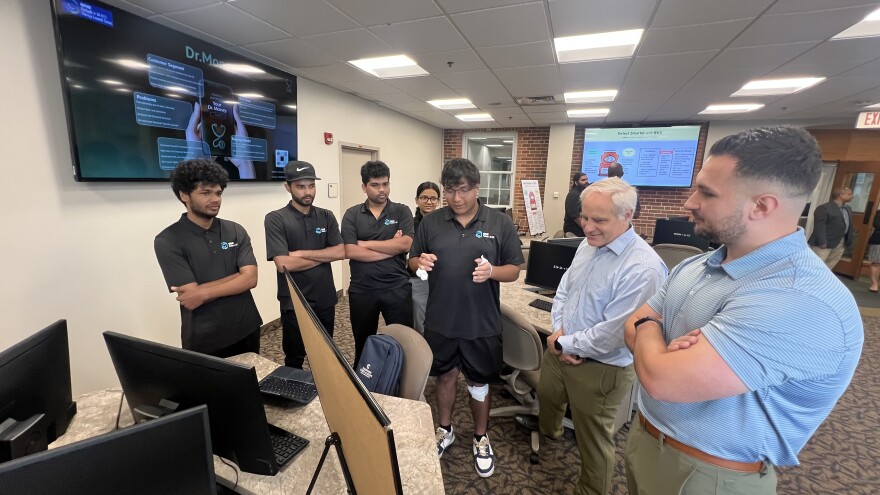

“We have made Doctor Money, which is going to be the doctor for your money - to create good financial habit or good financial health - that's what we ultimately want,” said Suman Dangal of Springfield College, leading one of the groups on July 9 in Western New England’s library.

His group developed Dr. Money as an “AI-first solution” that looks at bank statements, cash flow and spending habits and gives financial tips and reports in return says Dangal’s colleague, Sared Gaihre.

“It suggests you things, helps you manage the money, the flow of money, the places where you're spending money and it tries to help you budget things more clearly,” he explains. “It suggests you credit cards … sends you notifications ‘Here is the card that you want to use when you go to the store’ - it does things like that, and then it has other features, other perks as well.”

Dr. Money and two other groups made the cut earlier this year during an initial pitch competition, advancing from a group of eight to take part in a “Summer Innovation Fellowship” – all part of a “FinTech + AI 413 Startup Series” launched last year by WNE.

Sponsored by MassMutual and Country Bank, staff from both companies specializing in business insight and FinTech made the rounds, speaking with each group about their strengths and weaknesses, as well as the realities of the tech startup world.

Speaking with WAMC, Sterling Orr, executive director of the Western New England Fintech and AI Incubator, said the slideshows and videos on display were not just for show – the apps work, or at least function in a simulated environment.

He says some have a path toward going live if the students want to pursue it.

“They're built, they work, they're very impressive and they perform tasks that are necessary or missing in the in the current market,” he explains. “Now, it's time to get them better acquainted with speaking with stakeholders and pitching their ideas to c-suite executives. It's more about now refining their messaging, to make sure that it's what a VC or an early-stage investor would want to hear.”

Some students were so devoted, they were back presenting for a second year. The team behind “Smart Credit” showed off the latest iteration of their app, an AI-driven application designed to “assist users in selecting the optimal credit card for maximizing rewards at the point of purchase,” according to Western New England's website.

Among them is a double major in finance and computer science, Springfield College’s Dikshya Upadyaya. She was also pulling double-duty – being part of the team behind “OptiVise,” billed as an “intelligent course registration and planning platform,” one that can help students with academic planning.

She says whether her groups’ apps move forward, feedback from professionals like MassMutual’s head of Fintech and HealthTech Partnerships, is invaluable.

“It was really helpful in a sense, because at the end of the day, we're still not working professionals out there and the way he gave us tips, about having a very clear financial roadmap, in context of operational costs … what is the revenue that's coming in and what is the seed investment you're getting from different sectors … “ she said. “But also, we are held accountable for our vision.”

If anything, Orr adds, the showcase gives students insight into the part of the startup world that takes an app from concept to market.

“They’re amazing - they're entirely focused on getting their applications. They believe in their story and that's really half the battle, right there,” he says. “You've got to believe that you can make it happen. These aren't just kids putting together a capstone project. These are kids trying to build companies.”