With a property tax rate approved by the Springfield City Council, residents will see a decrease rate-wise, but on average, still see a bigger bill.

"Things are hard, things are tough, and people cannot continue to do this and still be happy in the City of Homes,” said resident Rhonda Hall-Reynolds Monday night in the city council’s chambers. “That's what we are – we are the City of Homes. And right now, the people are hurting."

Referencing hardships, the pain of increasing costs and other factors, Hall-Reynolds made their case for more relief ahead of the council’s tax rate vote Monday.

Councilors were once again tasked with approving rates affecting the city’s nearly 46,000 taxable parcels and the 150,000 residents living or working on them.

Ever since approving the city’s $928 million budget in May, securing tax relief became a priority for much of the council, especially in the face of rising property values.

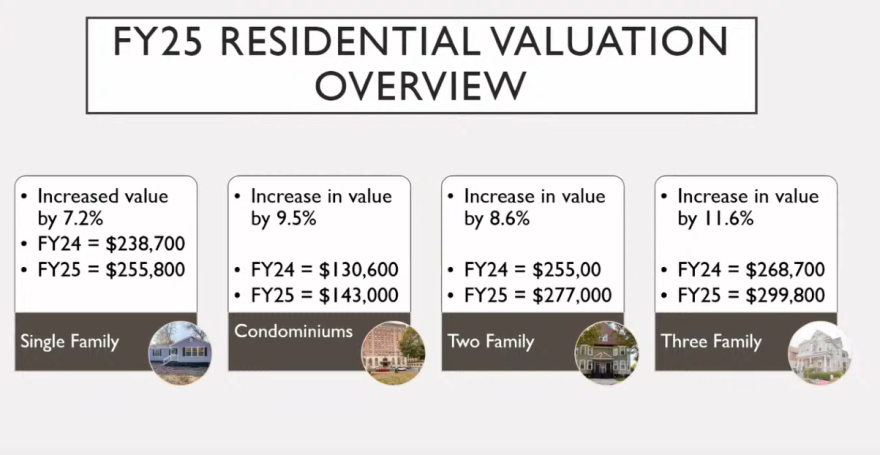

The increases and more were highlighted by Board of Assessors Chair Patrick Greenhalgh in a presentation before the vote.

“Our residential valuation generally, in FY 25 - there was an increase for single-family [homes] of about 7.2 percent, for condominiums it was 9.5 percent. Two families about 8.6 percent, and three families 11.6 percent,” he said. “So, we are still recognizing value increases in the market.”

For perspective, the average single-family home value went from $238,700 to $255,800 - an increase of $17,100.

In fiscal year 2024, the residential rate was set to $16.06 for every $1,000 – yielding $156.2 million or 61 percent of the $256 million total levy. In the process, the average single-family tax bill was $3,834.

For fiscal year 2025, the total levy rose to almost $272.1 million.

Also a factor in last year’s rate discussions – the city using more than $9 million to offset the levy.

Heading into the final stretch this year, it looked like about $3 million put forward by Mayor Domenic Sarno would be it, until the mayor committed to allotting another $3 million as calls for more relief continued.

Ward 7 City Councilor Timothy Allen said, at one point, the tax rate committee took an unorthodox step of motioning to request more aid.

“We knew that the committee that was setting the rate also wanted to ask the mayor for an extra $2 million to put on the taxes,” he recounted. “We talked to [Chief Administrative and Financial Officer] Cathy Buono and to Patrick, and we were able to ask the mayor for $3 million, and look, lo and behold, we got $3 million. That’s the original 3 and the 3 we asked for.”

That includes $4 million from certified free cash and $2 million from interest from an “innovative financial investment plan” involving U.S. Treasury Notes.

Following further discussion, the council approved a residential rate of $15.68 – a decrease of 38 cents from last year. But with property values rising the way they have, an increase of $177 is expected for the average single-family tax bill.

That led to two “no” votes – including from Councilor at Large Tracye Whitfield.

“There's people out there that can't afford a dollar, and I made it my personal vow that I will not vote for a budget that increased the tax bills and it's not going to change today, and it's not because of no one’s efforts here,” Whitfield said. “I think all of you did a great, wonderful, amazing job, but in my spirit and my conscience, I can't do that to the taxpayer.”

Also voting “no” for similar reasons was Ward 8 Councilor Zaida Govan.

She says the $6 million in relief is welcome, but for various residents across the city, any uptick hurts. Springfield’s median household income is $47,677.

Govan also suggested that making larger requests for levy relief in the future could yield better results.

“A lot of them can't afford it - not just in my ward, but in all the wards across the city,” the councilor said. “… the way I always see it is, if you go in asking for more … don't start low and go high – you’ve got to go high and then go low. So, I'm hoping that this will just be a lesson to us when budget season comes along and when we have an opportunity to really make an impact for our residents, that we do that at that time.”

The council also approved a shift from 1.735 percent to 1.75 for commercial or CIP tax rates – a shift Greenhalgh says helped ensure a larger reduction for residents.