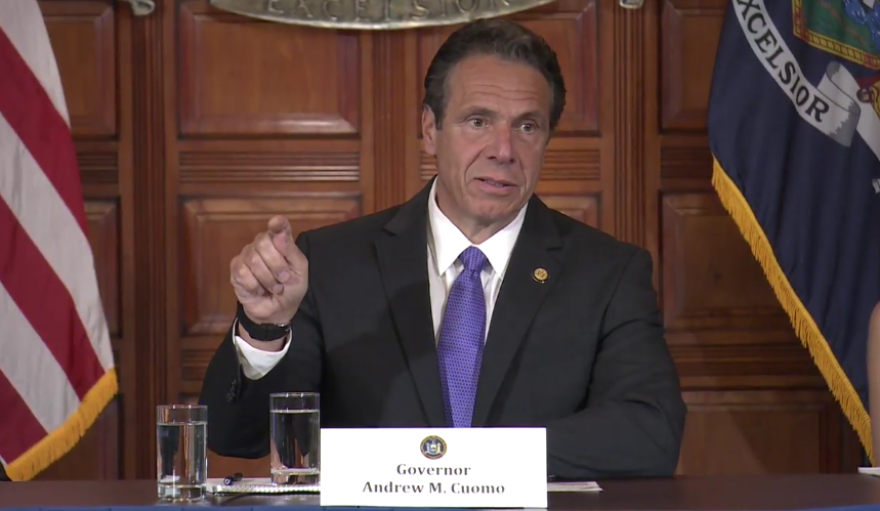

A decision by New Jersey leaders to raise taxes on the state’s wealthiest residents has given new hope to advocates who want to tax the rich in New York. But Governor Andrew Cuomo and his budget director are throwing cold water on that proposal.

New Jersey’s top tax rate for those making between one and five million dollars a year will rise to 10.75%. That rate already applied to people making over five million dollars a year.

Those who want to tax the rich in New York hailed the move and asked Governor Andrew Cuomo to follow suit.

Earlier in the week, Ron Deutsch, with the left leaning think tank Fiscal Policy Institute, made the case for increasing taxes on the state’s estimate 118 billionaires, who he says have increased their earnings since the COVID-19 pandemic began.

“Right now, the wealthy are doing just fine, the stock market is doing just fine,” Deutsch said. “Yet it’s the average New Yorker who is struggling day in and day out to deal with this pandemic.”

Cuomo said on September 10 that New York might have to raise taxes to deal with its massive budget deficit but since then has walked back those comments.

He spoke against raising taxes on the wealthy on Long Island News Radio.

“People say, well, raise taxes, raise taxes. I raise taxes, it puts the state at a competitive disadvantage because other people can go to other states and taxes are very high in the state to begin with,” the governor said on September 15. “But okay, raise taxes. If we went to the highest income tax in the country which is now California we'd lose a couple of billion dollars. A couple of billion dollars - we have a $50 billion hole. What am I going to do with a couple of billion dollars?”

And after the New Jersey tax increase was announced, Cuomo’s budget director Robert Mujica said in a statement that the “overwhelming majority of billionaires and millionaires in this state live or work in New York City,” where the combined state and city income tax rate is already higher than New Jersey’s new top tax rate.

David Friedfel, with the fiscal watchdog group Citizens Budget Commission, agrees. He says in the rest of the state the top income tax rate is 8.82% for those earning over $2 million a year. But the City imposes its own income tax as well.

“So when those two are added together, the top rates on people living in New York City is 12.7%,” said Friedfel, who says it’s the second highest rate in the country, after California.

California’s top tax rate is 13.3% for those making over $1,181,484 a year.

Friedfel says an existing income tax surcharge on New York’s wealthiest makes it difficult to further raise taxes on the rich. That surcharge, enacted in the Great Recession, was supposed to be temporary- but has been extended until 2024. If that date does not change, it will have been in effect for nearly two decades by then.

A Citizens Budget Commission study examined the long held claim by Cuomo and other opponents of increasing taxes on the rich that the wealthy will simply leave New York. The commission looked at the number of millionaires in New York between 2010 and 2017, a time when the state and the nation were in an economic recovery and the tax surcharge on the wealthy was in effect. It found that over those seven years, the number of millionaires in the nation grew overall. But New York’s share of millionaires fell.

“New York’s share of millionaires actually decreased by 15%,” Friedfel said. “From 13% of U.S millionaires, down to 11%.”

Friedfel says it’s not possible, though, to attribute that shift to any one factor.